- Insurance

-

-

Most Popular

-

-

- Investing

-

-

Most Popular

-

Best Of

-

-

- Banking

-

-

Best of

-

Banking Reviews

-

Explore More

-

-

-

- Loans

-

-

Most Popular

-

Explore more

-

-

- Credit Cards

- Reviews

- Making Money

Does Closing A Bank Account Hurt Your Credit?

Everything in life revolves around money. From the food that we buy to the services we use, in order to use any of them you have to have money first.

Written by:

Back before standardized banking, money being used willy-nilly wasn’t such a big issue, but as the economies of the world became centralized and streamlined and the populations of countries became huge and continued growing, checks and regulations became a requirement.

In order to keep using the economic system to its full potential, people started using loans to pay off debts, and loaners wanted to make sure that these people would pay them back.

Thus, the credit score system was born to keep track of people’s financial habits.

The birth of this system raised a bit of an issue, though.

Since banking was around long before credit was, would it be affected by it? If a person had never got credit but had a bank account all their life, would closing it impact their credit score? Today, that is the question we seek to answer, and we will tell you exactly the effect closing a bank account has on your credit score.

Table of Contents

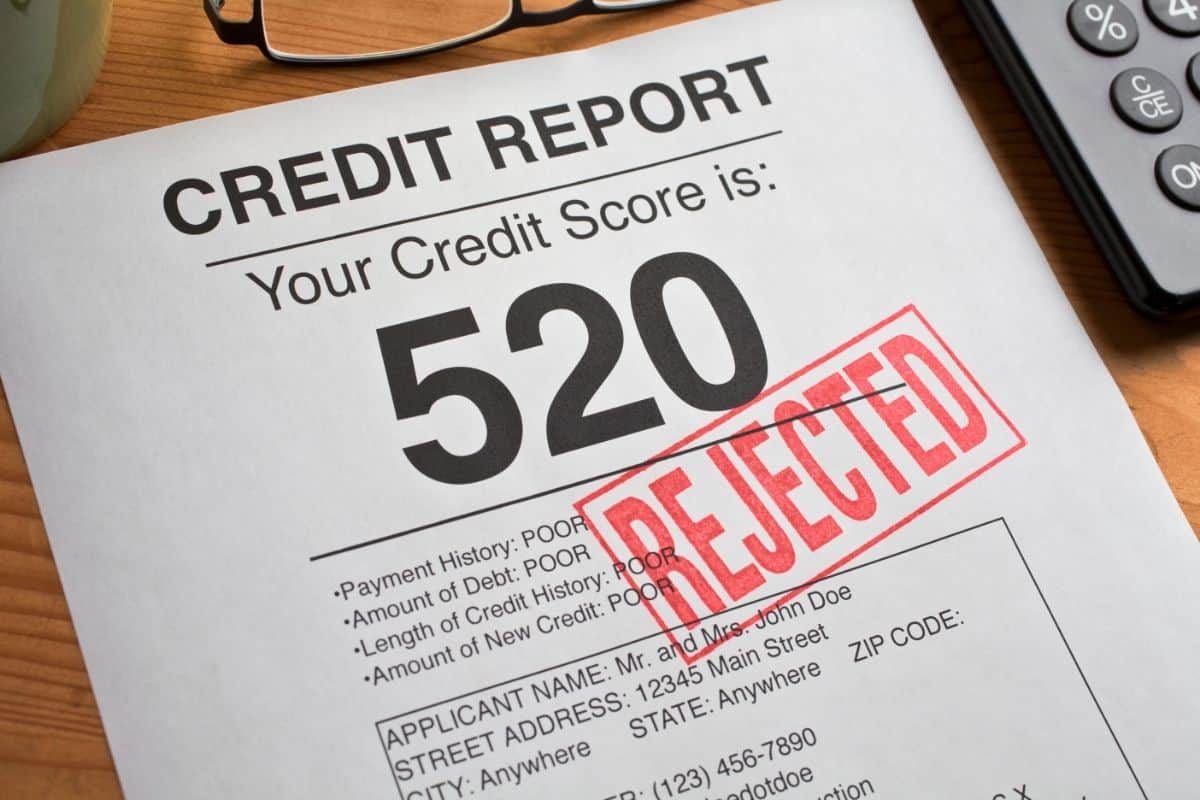

What Is A Credit Score?

A credit score is simply an indicator of how likely you are going to repay your debt or not.

This number is based on information found on your credit report, which contains details about your past financial history.

As stated earlier, this is done in order to provide lenders with a way of knowing whether they should let you borrow money or not.

There are three main factors that go into calculating your credit score: payment history, amount owed, and length of time you’ve been paying.

Payment history is one of the most important factors because it represents how responsible you are when it comes to handling your finances.

The other two factors are less essential than the previous one. As for what the average score is, it depends on who you ask.

Some say it’s anywhere from 700-850, while others say it can be higher than 1000. However, no matter what your score is, there is always room for improvement.

What Happens To My Credit Score If I Close My Bank Account?

Now that we know what a credit score is and why it’s so important, let’s see what happens to your score when you close your bank account.

When you close your bank account, the lender and those tracking your credit score will still have access to some of your banking records.

These records include transactions made through automatic bill payments, direct deposit, and online banking.

They also contain the type of transaction (credit card purchases, personal loans, etc.) and the amount of each transaction.

However, your credit score won’t reflect those transactions anymore, since you’re no longer making them.

In fact, the affected parties won’t even realize that you closed your account until you open another one sometime later.

That’s because banks use different criteria when deciding whether to give out new accounts instead of just renewing old ones.

For example, they may look at things like your income, employment status, assets, liabilities, monthly expenses, and more.

Now, this doesn’t mean that closing an account will affect your credit score, but if you still have payments to make from this account, then your score will be affected.

Since a credit score is an indication of how likely you are to repay a debt, closing an account with debts and payments still to make will look like you are trying to avoid paying and will directly impact your score.

Your credit score won’t change immediately because you haven’t missed any payments yet.

Closing your account doesn’t mean that you’ll start missing payments right away.

It takes at least 30 days after you close your account for your payment history to become void, and then debts will start not being paid.

At that point, lenders will only consider your payment history up until that day.

So if you don’t miss a single payment during that period, your score won’t drop much.

How Do I See My Credit Score?

If you want to check your score and find out how bad it is, then you need to request a free copy of your credit report from Experian.

You can get one every 12 months from the company. Once you receive it, take a moment to read it thoroughly.

There may be items listed on the report that you didn’t know existed. Also, make sure to sign up for alerts whenever your record changes.

This way, you’ll know when someone makes changes to it, and you can act accordingly.

If you think your score needs help, then you should definitely contact a professional.

A good place to start is at your local bank or to find local financial advisors.

Credit repair companies usually offer services such as monitoring your credit reports, helping you fix mistakes, and advising you on ways to improve your score.

They charge a fee for their service which varies depending on the length of the contract.

If you decide to hire one, make sure they have experience in dealing with consumers.

Avoid companies that claim to be able to raise your score by a certain number or remove negative information from your report.

It’s not possible to completely remove an item from your credit report, but you can try to negotiate with the creditor to reduce its impact.

Credit repair companies also sell products that promise to increase your score.

But these aren’t regulated by federal law, so you can’t rely on them.

Don’t pay any money upfront, either. Instead, set up a plan where you pay for your credit repair at regular intervals.

This way, you won’t end up spending more than what you originally agreed upon.

What Are My Options If I Found Errors On My Credit Report?

You can dispute any inaccuracies that you find on your credit report.

The first step is contacting the three major reporting agencies: Equifax, Experian, and TransUnion.

All three companies have toll-free numbers to call. You can ask questions about who owns the debt, how long it has been outstanding, and other relevant details.

Each agency will respond within two business days. If you still feel there were problems with the information, you can submit a dispute form.

When you file a dispute, be prepared to provide documentation that proves your identity and the validity of the debts.

Make sure to keep copies of everything you send. You can use this evidence later if needed.

Once you’ve filed a dispute, the next step is waiting. Depending on the issue, it could take anywhere from 60 days to 180 days before your dispute is resolved.

During that time, the credit bureaus will investigate the dispute.

They might pull your credit report to see whether the disputed items are accurate.

In some cases, they may need to speak with the creditors directly to verify the information.

Once they’re done, they’ll release updates to your credit report that reflect the changes.

Conclusion

Closing a bank account does not directly affect a credit score, that comes from having unresolved issues with your account – such as loans or debts – when you close it.

So, the best way to avoid having problems with your credit is to make sure everything is in order with your account before you close it.

Frequently Asked Questions

Bottom line. Closing a bank account that’s in good standing won’t hurt your credit score. If you have a negative bank balance, however, it’s important to resolve the balance before closing the account. Otherwise, your credit could suffer as a result.

A number of credit scoring models — including FICO, which is the score used most often by lenders — continue to count accounts for many years after you’ve closed them. So closing an account won’t have an immediate effect in those cases, but rather several years down the line.

Information about your bank account generally isn’t included on your credit report because it’s not thought of as credit. So closing your bank account shouldn’t affect your credit score. But if you close your bank account when you’re overdrawn, you could find that this does have an impact.

Join the MoneyMash community!

Sign up to get the latest personal finance news.

© 2025 MoneyMash an Element Road, LLC Company.

MoneyMash is an independent, advertiser-supported site. We may receive compensation when you click to apply for some products using the links that you find on our website. Opinions presented on our website are those of MoneyMash or our team of writers and reviewers who post their own opinions. For more information, please read the full disclosure.