- Insurance

-

-

Most Popular

-

-

- Investing

-

-

Most Popular

-

Best Of

-

-

- Banking

-

-

Best of

-

Banking Reviews

-

Explore More

-

-

-

- Loans

-

-

Most Popular

-

Explore more

-

-

- Credit Cards

- Reviews

- Making Money

Step-by-Step Guide on How to Close Self Account Effortlessly

Looking to close your Self Credit Builder Account? Our straightforward guide will walk you through how to close self account, focus on shielding your credit score and ensure a smooth financial transition without the fluff.

Written by:

Key Takeaways

- The Self Credit Builder Account helps individuals build their credit through fixed installment loans and a secured credit card, and it reports to all three major credit bureaus.

- You can close your Self Credit Builder Account anytime according to your financial goals and with consideration of potential impacts on your credit score and utilization ratio. Settle all outstanding balances before closing to avoid issues.

- Maintain financial documents post-closure and consult professionals for advice on the length of time to keep these records, which can be crucial for addressing any future financial or legal disputes

Table of Contents

Exploring the Self Credit Builder Account

A Self Credit Builder Account is a powerful financial tool designed to help individuals, particularly those without prior credit history, build their credit. Think of it as a stepping stone towards a stronger financial future. Users can establish a solid credit history through regular, manageable payments with a fixed installment loan.

But that’s not all. The Self Credit Builder Account is paired with a secured credit card – the Self Secured Visa Credit Card, which can further enhance your credit score when used responsibly. This dual-faceted approach ensures that you’re not just building credit but doing so in a sustainable and impactful way.

Moreover, the account reports to all three major credit bureaus, making it accessible and beneficial for individuals from various financial backgrounds. Through comprehensive reporting, your credit-building efforts are recognized across the board, paving the way for future financial opportunities.

Considering Cancelation: Why End Your Self Credit Builder Journey?

Achieving your desired credit score is a significant milestone, and for many, it signals the end of their journey with the Self Credit Builder Account. Once you’ve reached this goal, you might consider other avenues for maintaining or further improving your credit. But there are other reasons why one might choose to cancel their account, such as:

No longer needing to build credit

Switching to a different credit-building method

Financial circumstances have changed

Dissatisfaction with the Self Credit Builder Account

Whatever the reason may be, if you decide to cancel your account, make sure to contact Self and follow their cancellation process.

Personal circumstances, such as separation or divorce, can necessitate a reevaluation of your financial tools. Additionally, high annual fees associated with credit-building accounts can become a burden, prompting users to seek more cost-effective solutions. And let’s not forget the temptation to overspend, which can derail your financial discipline.

Weighing these factors carefully is important. The decision to close your Self Credit Builder Account should align with your broader financial goals. Understanding the reasons behind this choice enables you to make an informed decision that supports your long-term financial health.

Pre-Closure Checklist: What to Know Before Saying Goodbye

Prior to proceeding with closing your Self Credit Builder Account, considering a few key points is necessary. Above all, comprehend the financial implications. If you choose to cancel your account early, you may receive a return of the money paid minus any interest, administrative fees, and potential early withdrawal penalties.

Another critical factor is the impact on your credit score. Closing an account can affect your credit utilization ratio, which plays a role in your overall credit score. Ensure all balances are settled before closure to avoid complications down the line.

Timing is also crucial. Plan your account closure carefully, considering any upcoming financial needs or obligations. Aligning the closure with your financial timeline minimizes disruptions and ensures a smooth transition.

Step-by-Step Closure: Navigating the Self Account Termination Process

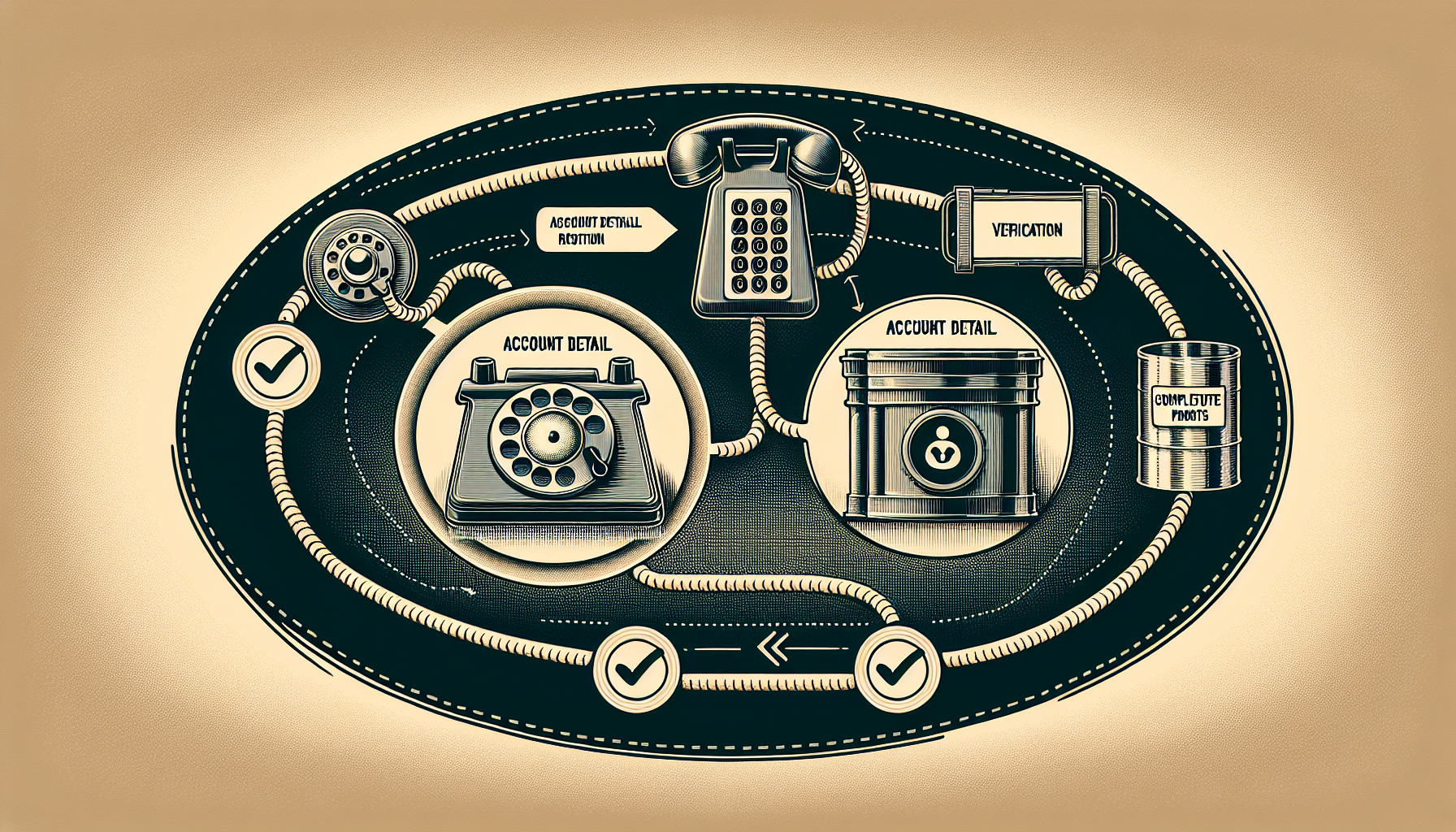

Closing your Self Credit Builder Account is a straightforward process if you follow the right steps. The journey begins with using the designated automated phone system by dialing a specific number. This system is designed to streamline the process, making it as hassle-free as possible.

Account closure requests are processed and become effective at 11 PM CST on the same day the request is made. This means you can plan your closure to coincide with your financial schedule, ensuring that all transactions are completed efficiently.

Once your account is closed, you can monitor the payment status through a payout tracker available on your dashboard within 24 hours. This feature provides peace of mind, allowing you to keep track of your final payments and ensure everything is in order.

Verify Account Details

The closure process begins with the crucial step of verifying your account details. The automated phone system will guide you through this verification, ensuring that all your information is accurate and up-to-date. Preventing any delays or issues during the closure makes this step essential.

Alongside verifying your account details, the system will provide valuable information regarding credit reporting and payout details. This ensures that you are fully informed about the implications of closing your account and how it will be reported to the credit bureaus.

Additionally, confirm any other necessary personal information not covered by the automated phone system. This comprehensive verification will ensure a smooth and efficient account closure process.

Settle Any Outstanding Balances

Settling any outstanding balances is imperative before you can close your Self Credit Builder Account. This ensures that there are no loose ends that could complicate the closure process. All remaining balances must be settled within 60 days after the account closure to meet AWS’s requirements.

Failing to settle your outstanding balance within the specified timeframe can lead to additional steps or complications. It’s best to address all financial obligations promptly to avoid any potential issues.

Moving forward with the account closure confidently is possible by ensuring that all pay requirements are met, including settling payments and balances, as you know that you have met all necessary requirements.

Follow the Prompts to Close Your Account

Once you have verified your account details and settled any outstanding balances, the next step is to follow the prompts to close your account. Navigate to the settings in your account dashboard and select the option to close your account. This will initiate the closure process.

The system will guide you through several prompts, asking you to confirm the cancellation and informing you of any potential impacts on your credit score. You will also need to acknowledge the terms of closing your account.

Finally, you will receive a confirmation message once your Self Credit Builder Account has been successfully closed. This confirmation ensures that your account closure has been processed and finalized.

Aftermath of Account Closure: What Happens Next?

Once your Self Credit Builder Account is closed, it will be reported as ‘paid as agreed’ to the credit bureaus. This positive account history will remain on your credit reports for up to 10 years, which can benefit your credit score in the long run. However, it’s important to note that closing your account may impact your credit utilization ratio, which is a factor in calculating your credit score. For a healthy credit score, maintaining a low credit utilization ratio is crucial.

For those who hold a Self Visa Credit Card, you can continue to build your credit history even after the closure of your Self Credit Builder Account. This provides an ongoing opportunity to strengthen your credit profile.

Navigating Potential Roadblocks: Troubleshooting Common Issues

Closing an account isn’t always smooth sailing. If you encounter issues, refer to resources like ‘Troubleshooting issues with AWS account’ for solutions. These articles can provide guidance on navigating common roadblocks.

Additionally, if you have Platinum Protection, you need to disable this protection separately before using the automated phone system. To avoid any interruptions during the closure process, this step is crucial.

Maintaining financial documents post-closure is also essential. These records can be necessary for disputing claims, verifying transactions, and proving the absence of fraudulent activity. Keeping these documents ensures you are prepared for any future financial or legal issues.

Protecting Your Financial Footprint: Record-Keeping Post-Closure

Keeping your financial records is vital after closing your account. These records can help address future financial or legal issues that may arise. The timeframe for keeping these records can vary based on the statute of limitations for different legal matters, such as:

IRS audits

Tax disputes

Insurance claims

Property disputes

Legal actions

It is recommended to consult with a financial advisor or attorney to determine the specific timeframe for keeping your records in each case.

Investment and retirement accounts generally require a longer retention period than other accounts. By maintaining these records, you can ensure that you have the necessary documentation for any potential future needs.

Staying organized and keeping detailed records, for example, will help protect your financial footprint and provide peace of mind by maintaining a well-organized file.

Summary

Summing up, closing your Self Credit Builder Account is a meticulous process that requires careful consideration and steps. Verifying account details, settling balances, and following the prompts are critical actions to ensure a smooth closure. These steps help avoid complications and safeguard your credit history.

Remember, the aftermath of account closure involves understanding how it affects your credit report and maintaining financial documents for future reference. By staying informed and prepared, you can navigate this process effortlessly.

As you move forward, keep in mind the importance of responsible financial management. Closing one chapter opens the door to new opportunities, and with the right knowledge, you can continue to build a robust financial future.

Quick Questions

A Self Credit Builder Account is a financial tool that can assist individuals in building their credit by combining a fixed installment loan with a Self Secured Visa Credit Card, which reports to all three major credit bureaus

You should consider canceling your Self Credit Builder Account if you have achieved your desired credit score, personal circumstances have changed, or if you are facing high annual fees or spending temptation. These are valid reasons for cancellation.

Before closing your Self Credit Builder Account, consider the impact on your credit score, settle all balances, and plan the timing to avoid financial disruption. Timing and settling balances are crucial, and consider the potential impact on your credit score.

To close your Self Credit Builder Account, use the automated phone system, verify account details, settle any outstanding balances, and follow the prompts to complete the closure process.

After closing your Self Credit Builder Account, it will be reported as ‘paid as agreed’ to the credit bureaus and the positive account history will stay on your credit reports for up to 10 years. However, it may impact your credit utilization ratio.

Join the MoneyMash community!

Sign up to get the latest personal finance news.

© 2025 MoneyMash an Element Road, LLC Company.

MoneyMash is an independent, advertiser-supported site. We may receive compensation when you click to apply for some products using the links that you find on our website. Opinions presented on our website are those of MoneyMash or our team of writers and reviewers who post their own opinions. For more information, please read the full disclosure.